- Once again, fewer small and medium-sized sailing boats sold in 2024 than in the previous year

- The general reluctance to spend is also having a noticeable impact on the boating industry

- Sailing schools are back to their old level after the corona-related boom

- Hope for at least a gradual end to the ongoing downward trend

The German government has significantly lowered its economic forecast for the current year. According to the annual economic report presented a few days ago, growth of only 0.3 per cent is expected. In autumn, the government had still expected gross domestic product to increase by 1.1 percent. Last year, the economic output of Europe's largest economy shrank for the second year in a row. Expectations for 2026 have also been lowered.

What does this mean for the water sports industry in this country?

In short, it does not remain unaffected. On the contrary. The more or less stagnating economic growth, the unsatisfactory interest rate trend and, above all, the acute threat of thousands of industrial jobs being lost is putting shipyards, dealers, chandlers, service companies, sailing schools, harbour operators and charter companies under considerable pressure in some cases.

Once again, fewer small and medium-sized sailing boats sold in 2024 than in the previous year

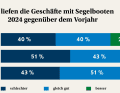

This is shown by figures for 2024 compiled by the German Water Sports Industry Association (BVWW), with manufacturers and dealers of small and medium-sized sailing boats being among the hardest hit. According to the companies surveyed, sales in these two segments declined in 2024, as in the previous year, or at best remained stable, but then mostly at a low level.

Only sales of yachts twelve metres in length and above fared somewhat better. For this segment, at least 20 per cent of respondents reported an increase in turnover compared to 2023.

The general reluctance to spend is also having a noticeable impact on the boating industry

BVWW Managing Director Karsten Stahlhut blames this development first and foremost on the sharp rise in purchase prices for sailing yachts, in addition to general consumer restraint. This has serious consequences for the charter market in particular, which is traditionally the largest buyer of mass-produced vessels.

Karsten Stahlhut:

"The now very high costs of new boats hardly lead to an adequate return on investment in the charter boat sector."

The limit price for new charter boats, i.e. the cost threshold up to which customers are prepared to hire a boat, cannot be pushed up indefinitely. Stahlhut: "Customers then prefer to book a model that is two years older and 30 per cent cheaper. This behaviour will certainly have a major impact on the large-scale shipyards, and countermeasures should be taken."

Sailing schools are back to their old level after the corona-related boom

According to the BVWW survey, many sailing schools, which in the past usually recorded growth even when all other segments of the water sports industry were complaining about a drop in business, have also recently seen a decline in the number of participants in driving licence courses. A third of training companies were in a worse position at the end of 2024 than in the previous year.

Karsten Stahlhut:

"However, it must be said that schools experienced an incredible boom during the coronavirus years. This puts the current declines in this area into perspective."

By contrast, business was at least stable for German charter companies. The largest fleet operators in this country are based on the Baltic Sea. 77 per cent of them stated that they ended 2024 neither worse nor better than 2023. 15 per cent reported losses and eight per cent reported an increase in sales.

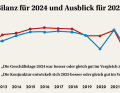

"Overall, it can be said that only 46 per cent of all companies surveyed stated that they had performed better or at least as well as in the previous year. In contrast, 54 per cent reported a negative trend," says Stahlhut, summarising the survey results.

Hope for at least a gradual end to the ongoing downward trend

Nevertheless, most entrepreneurs are of the opinion that the downward trend will gradually come to an end in 2025. Around 43 per cent still believe that the economy will continue to decline this year. In the previous year, however, 60 per cent were still significantly more of this opinion. 37 per cent (2023: 32 per cent) now believe that economic stagnation is the most likely scenario. And even a fifth hope that the market will pick up slightly (2023: 18 per cent).

According to some market players, a corresponding development has already been observed. Karsten Stahlhut: "While many retailers had nothing going on for months, there was a small interim revival in late summer and autumn, which was noticeable both in bricks-and-mortar retail and at the autumn trade fairs." Whether this is a long-term trend or just a flash in the pan remains to be seen. The fact is that many retailers are currently offering relatively large discounts in order to reduce their high stock levels.

Karsten Stahlhut:

"That's certainly helpful for the time being," says the association's managing director, "but in the long term, it's hardly sustainable."

Pascal Schürmann

Editor YACHT