The right policies for:

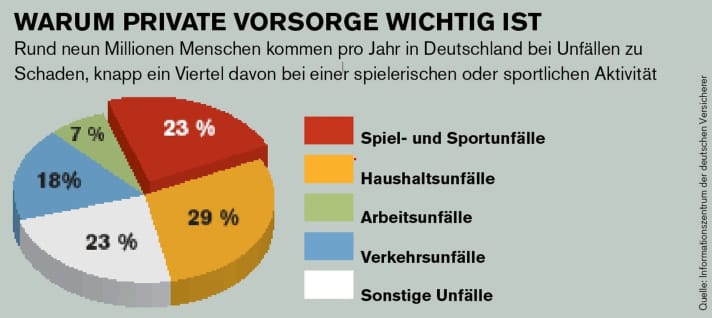

Sailing is sport. Even if it's not always immediately obvious when you're enjoying a cosy Sunday afternoon sail. And yet every boat trip, whether in a dinghy or on a tall ship, is associated with a higher risk of accidents compared to being on land.

Not a big one - according to Arag, Germany's largest sports insurer, there is just one injured sailor for every 15 injured footballers. However, the potential risk to people and equipment cannot be completely dismissed. Especially when something happens while sailing, the accidents are often serious, according to the Arag statistics. For example, serious head injuries or collisions with high material damage.

Fortunately, you can insure yourself against almost any kind of risk when sailing. Mind you, you can, not must. Unlike car owners, for example, there is no statutory insurance requirement for sailors in Germany.

Nevertheless, even in this country, no-one should set sail completely without cover, whether skipper or crew member. However, it always depends on the individual situation as to which insurance policy makes sense or not.

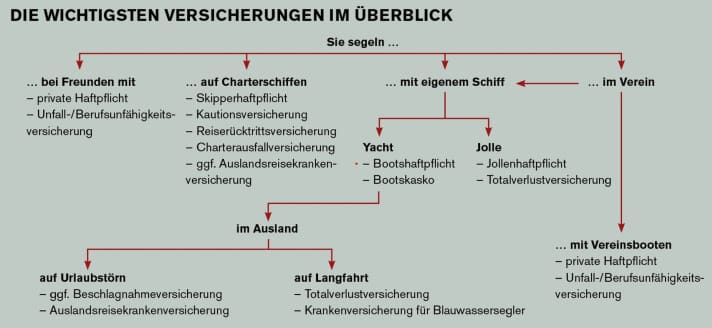

The choice is yours: below the overview chart, click on the type of sailor you are and read which insurance policies are available for you - and whether they make sense or not. You may be eligible for several types of sailing insurance.

The co-sailor

For all those who sail on the boats of friends or relatives and who sometimes take the tiller, but not the responsibility.

After Section 823 of the German Civil Code Everyone is liable to an unlimited extent for damage that they culpably cause to others. And with all of their present and future assets. To prevent this, there is theprivate liability insurance. Nobody should go through life without such a policy. It covers the everyday risks of private individuals, including liability arising from sports activities.

Anyone who sails with friends, whether sporadically or regularly, is therefore on the safe side with personal liability insurance. Depending on the insurance company, only dangerous leisure activities such as shooting, gliding or certain types of martial arts are excluded. Damage caused intentionally is also excluded from the obligation to pay benefits.

If, for example, expensive equipment is broken, the boat is damaged or another person suffers a serious injury due to the negligence of a crew member, the skipper will initially have to answer the question of whether he has instructed his crew correctly. However, if it turns out that the skipper did everything correctly, the person responsible will be held accountable - or their insurance company.

Experts recommend a sum insured of at least three million euros for personal injury and property damage and at least 500,000 euros for financial losses.

The use of your own boats is also often no longer covered by insurance in general or above a certain size. However, anyone who only sails on other boats is not affected by such a clause.

In addition, a co-sailor also runs the risk of being injured on board. Sometimes so much so that permanent physical impairments are the result, leading to the partial or complete loss of the ability to work or earn a living. Even if an accident cannot always be prevented, the financial consequences can be minimised. Keyword: private provision. At least oneAccident insuranceshould have been completed by an occasional co-sailor, better still aOccupational disability policyThis is to avoid having to rely solely on state support in the event of a permanent loss of earnings - which would be meagre anyway.

Accident insurance covers full or partial disability. If, for example, a thumb is jammed in the winch while tightening the sheet in such a way that it has to be amputated, this results in a 20 per cent disability according to the official limb tax. The person affected receives one fifth of the agreed sum insured.

The accident insurance benefit is intended to compensate for the loss of earnings resulting from the accident, cover any necessary disability-related modifications to the home or house and enable additional aids or therapies not covered by the health insurance or pension insurance provider.

The German Insurance Association has the following rule of thumb for the amount of cover: 30-year-olds should insure six times their gross annual income, 40-year-olds five times and 50-year-olds four times their gross annual income. Below www.bundderversicherten.de The following is a list of other important aspects that everyone should pay attention to when taking out private accident insurance, such as the agreement of a so-called progression or the waiver of an accident pension agreement.

If the family of a co-sailor should not suddenly find themselves in financial difficulties, especially in the worst case scenario - an accident resulting in death - aTerm life insurancefurther. The sum insured should correspond to at least one, preferably two years' gross income so that the surviving dependants have enough time to reorganise their lives without financial pressure.

The dinghy sailor

For all owners of open keel or centreboard boats who pursue their hobby on inland waterways or near the shore of a coastal area.

"Up to five metres in length", "up to ten square metres sail area", "up to four hp engine power" - especially in olderPersonal liability contracts liability arising from the ownership or use of smaller boats is often included in the insurance. A look at the small print brings clarity. However, if there is a corresponding risk exclusion, the following applies: even a supposedly small Opti or Laser can cause a great deal of damage, so taking out aBoat liability is therefore advisable.

For example, it will cover you if the helmsman overlooks a swimmer, sails over them and causes them serious injury. Or if the rower fails to dock and their own boat rams into a neighbouring boat.

As liability claims tend to be limited for small, open boats, some insurers offer special tariffs that are significantly cheaper than the policies for large vessels. Special tariffs for optis, dinghies and sports catamarans are sometimes limited to certain boat types, sometimes to different inland areas.

A conventionalComprehensive insurance is often not worthwhile for dinghy owners. This is because many parts that could break would fall under the excess. Without such a contractually fixed deductible, however, the premium would quickly become immeasurable.

However, at least one eventuality should be covered: the total loss of the boat. Be it because it capsizes and sinks irretrievably, because it catches fire or is stolen. Or because so many parts are broken as a result of a collision with a larger boat that their replacement or repair exceeds the total value of the dinghy.

For this purpose, small boats can use theTotal loss insurance, sometimes also referred to as partial casco. This has nothing in common with the policy of the same name from the motor vehicle sector, but only applies as described in the event of an actual or economic total loss.

Dinghy liability and total loss policies are available for around 100 euros a year. In addition, a dinghy sailor should of course insure himself like everyone else againstAccident risks secure.

The yacht owner

For all owners of sailing boats that are suitable for shorter or longer trips. And who are not always travelling alone.

Since a large vessel can cause far greater damage to other people's property than a dinghy - in the harbour, for example, a neighbour's ship's side can be scraped by the anchor gear when entering the box - no one should enter the harbour without a dinghy.Boat liability policy cast off the lines.

Also aComprehensive insurance is strongly recommended. It covers damage that occurs to your own boat. For example, if the mast comes down out of the blue. Or if the boat capsizes in heavy weather and water ingress paralyses the electronics.

For owners of classic boats there areSpecial classic policieswhich are specifically tailored to their particular insurance requirements. For example, it states that customised products and any extraordinary craftsmanship required are covered.

The boat hull insurance may also step into the breach if a third party causes damage but does not have to pay for it by law - keyword: strict liability vs. polluter pays liability - or cannot do so due to an acute lack of funds. Or if the other party involved in the accident has simply absconded.

In the latter case, there would only be money from the liability insurance if a specialBad debt cover has been agreed. Sometimes this is included in the basic policy, sometimes you have to buy it separately. However, the prerequisite is that a title has been obtained against the party responsible for the damage.

Please note that the breakdown policy only pays compensation in the amount of the statutory liability. In concrete terms, this means that the insurance will reimburse the current value, not the replacement value. If, for example, a collision means that an ageing mast has to be replaced, the insurance company will only reimburse part of the costs. The improvement in value resulting from the repair of the damage is deducted from the invoice.

Experts therefore advise that such damage should be covered by boat hull insurance. Provided that this not only covers the current value of the yacht, but also its original purchase or market value in the form of a fixed valuation. It must also be stipulated that the insurance company waives new for old deductions in the event of partial damage. If this is the case, the new mast, for example, would be fully reimbursed by the hull policy. Or at least the difference to the new value if the other party's liability reimburses the current value.

Please note that not every fixed premium is actually fixed. When concluding the contract, make sure that the sum insured is actually paid out in full in the event of a claim. This is best confirmed by the insurer. Otherwise there may be unpleasant surprises if, in the event of a claim, only the current market value is paid out instead of the sum insured stated in the contract. An indication of a fixed premium worthy of the name is if the term "replacement value insurance" appears in the policy conditions.

Some insurers also feel bound to the fixed rate only for a certain period of time, for example ten or 15 years. After that, the insured person must expect deductions.

Finally, a note for all those who like to leave the national borders behind on their own keel: ATravel health insurance should then be compulsory. It costs little, but in the event of a claim it will cover the additional costs that may be incurred if medical treatment is required abroad.

That's all a yacht owner needs to begin with - even if the insurers have other offers up their sleeves. For example thePassenger accident policy. In addition to the policyholder, it is also intended to protect friends, strangers or relatives from the financial consequences of a mishap on board. However, it only applies when sailing, at best when going ashore between two legs, but not in everyday life. However, everyone should take out comprehensive cover for all situations in life.Accident and incapacity for work risks take care of it. In addition: If a skipper or - with a good boat liability insurance - a crew member is at fault for an accident in which fellow sailors are injured, the boat liability insurance will apply within the scope of statutory liability.

As a rule, there is only no money from the boat liability insurance if the yacht is damaged or the policyholder, usually the skipper or their own person, is injured as a result of the culpable actions of a crew member. However, at least as far as personal injury to the policyholder is concerned, there are providers whose boat liability insurance even covers this risk.

One argument in favour of passenger accident insurance is that it can be difficult to enforce liability claims against third parties, especially abroad. And: money is paid even if the skipper is not at fault.

There is also plenty of room for debate about the benefits of a specialLegal expenses insurancefor yacht owners. Basically, it's fair to say that anyone who can manage without such a policy in normal life will probably be able to do without one for their hobby.

Also uninteresting for most sailors: theConfiscation insurance. At least those who sail within or on the North and Baltic Seas will rarely find themselves in a situation where their boat is chained up by the police. And if you do, you can probably assume that the action taken by the local authorities is lawful and not an act of arbitrariness. Things can undoubtedly be different in some Mediterranean regions. Anyone who has a berth for their boat in Greece, Croatia, Turkey or Cyprus, for example, and sails there frequently, is more likely to be caught up in the bureaucratic mills due to a violation of environmental laws or entry regulations, for example. Or because they have been involved in an accident with their boat.

The regatta sailor

For all dinghy and tall ship sailors who are looking for fair competition with like-minded people, whether inland, off the coast or offshore.

The discussion a few years ago as to whether regatta sailing should generally be regarded as a combat sport is fortunately now off the table. This means that after a collision, injured crews can assert claims for damages against the party responsible as normal. The German Sailing Association has negotiated a kind of standstill agreement with Düsseldorf-based Arag, which everyone else is also honouring.

As long as there is no wilful intent involved, the insurance companies are still obliged to provide cover for regattas. However, this does not automatically apply to damage that occurs to your own boat during a race, with or without third-party fault.

Anyone taking part in the race for the buoys with their dinghy or yacht should therefore not only check which insurances are available asDinghy sailor orFat ship owner could generally be of importance to him. He should also have taken a careful look at the small print of his policies. This will either contain the information that theRegatta risk is included in the contract or not. In the latter case, the policy can usually be extended accordingly for an additional premium.

Also interesting for regatta sailors: theScope of application of their policies. Anyone who tours a lot at home and abroad with their boat to racing events should make sure that they have insurance cover not only on their home territory. It is not necessary to arrange - and pay for - insurance cover for every area of the world. It is often sufficient to include a note in the policy stating that cover is also provided for short-termExceeding the travelling area does not expire.

In addition, regatta sailors, like any other active sportsperson, are naturally at an increased risk of injury. AAccident insurance or aOccupational disability policy should therefore be available.

The club sailor

For everyone who is in a sailing club, owns a boat or sails with the club boats. And who take part in regattas for their club.

Almost all sailing clubs in Germany are affiliated to the DSV, which means that they are members of their respective state association. At the same time, the clubs are also members of one of the state sports associations. These have for their membersGroup insurance most of them, 14 out of 20 state sports associations, with Arag-Sportversicherung.

When practising their hobby in the club, every sailor is therefore, among other thingsaccident and liability insurance. Whether this only applies to the use of the club's own boats or also to those of its members depends on the respective contract that the individual state sports associations have concluded with Arag. If in doubt, ask your club.

However, it is irrelevant whether an accident occurs during a regatta, during training, on a casual squadron trip, as part of working hours or at the club party on land. The journey to training or the journey to the regatta is also insured. However, the club does not provide insurance cover if you take your own boat on trips outside the club. In this case, the general insurances forDinghy sailor andYacht owner.

A sailor must be sent to a regatta by his club for insurance cover to be provided by the club. This is particularly the case if the regatta is not held on the home territory. In practice, it has become common practice to enter your own club on the organiser's entry list. But be careful, you should not simply register anywhere without the knowledge of your club committee. If an accident occurs, the sports insurer will require confirmation that you have been sent.

In principle, sports insurance offers a kind of basic protection. If a sports injury results in disability, the person affected receives financial support. If they unintentionally but culpably cause damage to others, they are not liable with their personal assets.

However, the sums insured under sports insurance are comparatively low. It is by no means a substitute for private insurance. In particular, anyone who takes part in club activities with their own boat should take out higher liability and, if necessary, hull insurance. Hull damage to boats is not covered by sports insurance.

Some yacht insurers grant discounts if you are a member of a sailing club. This can lead to a partial cancellation of the insurance.Double insurance come. But that is not a problem. If the worst comes to the worst, it is sufficient to inform the insurers of the existence of the other company so that they can divide the settlement of the claim between them.

Different in terms ofAccident insurance. If you have taken out such a policy yourself, both companies will pay out the agreed sum insured in the event of a disability following an accident, so you collect twice. Important: Secure claims early on.

Apparent minor injuries are also reported, even if no protracted healing process or even permanent physical impairment is initially to be expected after an injury. Depending on the state sports association, transitional benefits or daily hospital allowances may also be agreed for club athletes. Accidents should be reported as early as possible.

Anyone who holds an office in the club, whether as a board member or boat warden, also benefits from sports insurance. Volunteers are not only covered by conventional liability insurance. OneFidelity, builder-ownerand Legal protection policy are also part of the contract. Individual sports federations have also concluded aFinancial lossand one Health insurance completed.

Furthermore, non-club members can also be covered by Arag sports insurance. This is important, for example, when taster sailing events take place.

And finally, the club is insured as the organiser of regattas or other events as long as this is done under the umbrella of the responsible national association. However, if a club organises a German championship, the DSV, as the umbrella association, has set up a separateOrganiser insurance completed.

Associations can also protect their volunteer members against high financial losses through conventional insurance policies.Yacht Assurance Broker insure.

As a rule, normal club members are only authorised to communicate with each other with regard toMaterial damage liable to pay compensation. In the case of public officialsPersonal injury Liability cover. For example, there is money from the sports insurance if a coach orders a measure in which one of his protégés is injured.

The charter sailor

For all those who rent a yacht for themselves and their family or together with friends to go on holiday cruises at home or abroad.

ThePersonal liability does not cover personal injury or damage to property caused by a skipper. For your own boat there is theBoat liability. But what should you do if you want to charter a yacht for a holiday cruise? Then theSkipper liability.

It covers claims made against the skipper by injured crew members and third parties. Even if the skipper cannot be accused of culpable behaviour. Some providers even offer insurance cover in the event that the skippergrossly negligent deals.

The following also applies to charter trips abroad in particular: it is not always possible to determine whether the charter company has taken out a boat liability policy for the rented boat, how high the policy's cover is and how much it covers.Cover and whether thePremiums have been paid on time. In short, the skipper does not know whether there is sufficient insurance cover.

If not, he is liable with his private assets in the event of damage. Skipper liability also protects them against this. Owners who take out a liability policy for their boat can benefit from free skipper's liability cover with many insurance companies.

If the vessel is not available for the next crew after the cruise due to damage for which the sailors are responsible, the charter company shallCompensation for damages demand. TheReceivables or charter default cover. It is sometimes included in the skipper's liability insurance, sometimes only available for an additional premium. The same applies to theConfiscation insurance.

It is not uncommon for a dispute to arise during a holiday cruise if a fellow sailor damages the boat or equipment. Then everyone's deposit is lost. To prevent this from happening, the crew can draw up an appropriateBond insurance finalise.

Security deposit insurance is available from various providers. It is often limited to a specific cruise. If you charter more frequently, it may be cheaper to take out an annual contract.

OneTravel cancellation policy is needed if you book well in advance or want to go on a trip with a large crew. In the charter sector, it protects in particular against the skipper dropping out and not being able to be replaced, meaning that the entire trip has to be cancelled, whether before the start or during the trip. If an individual crew member cancels, the insurance covers their share of the travel costs.

Finally, charter sailors who are covered by statutory health insurance should also refer to the International travel health insurance pointed out. Private health insurance policies often already include cover abroad.

In general, it is important to determine your own needs very precisely and then compare prices. Some insurers offer various charter insurance policies as complete packages, while other providers offer each policy individually.

The long rider

For all those who want to go on a cruise with their own boat for several months or even years. And who are heading for destinations far from home.

Anyone who goes on a blue water cruise around the world or simply takes a break of several months to explore the Mediterranean or the Atlantic on their own keel, for example, often has to keep a close eye on the money.Boat liability and hull policies, which also apply in remote areas, are expensive.

One solution: You should not do without liability insurance under any circumstances; the normal hull policy is most likely to be dispensable. Even at the risk of having to repair damaged equipment yourself or replace it out of your own pocket. Only against theTotal loss of the ship, long-distance crews should take out insurance so that they are not left completely empty-handed in the event of sinking, stranding or theft.

Only apply for insurance cover for distant destinations for the period in which you will actually be there. Permanent worldwide cover is expensive and makes little sense if you are travelling for several years, for example on the barefoot route.

No less important is aHealth insurance. It is also normally prohibitively expensive if it is to be extended to distant countries over a longer period of time. The solution: special offers from the yacht insurance industry for blue water sailors.

Pascal Schürmann

Editor YACHT

Pascal Schürmann joined YACHT in Hamburg in 2001. As head of copywriting and head of the editorial team, he makes sure that all articles make it into the magazine on time and that they are both informative and entertaining to read. He was born in the Bergisches Land region near Cologne. He learned how to handle the tiller and sheet as a teenager in a touring dinghy on the Sneeker Meer and on a tall ship on the IJsselmeer. During and after his studies, he sailed on the Baltic Sea and in the Mediterranean. As a trained business journalist, he is also responsible for boat financing and yacht insurance reports at YACHT, but also has a soft spot for blue water topics.